Retained earnings refer to the money your company keeps for itself after paying out dividends to shareholders. According to this rule, an increase in retained earnings is credited and a decrease in retained Food Truck Accounting earnings is debited. This is a rule of accounting that cannot be broken under any circumstances.

How to Test Completeness of Accounts Payable

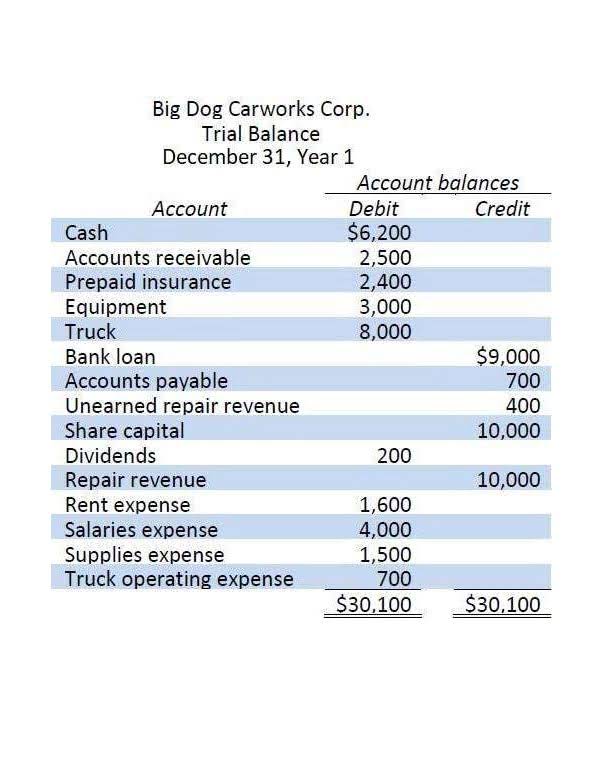

If the balance in the Retained Earnings account has a debit balance, this negative amount of retained earnings may be described as deficit or accumulated deficit. At the end of an accounting year, the balances in a corporation’s revenue, gain, expense, and loss accounts are used to compute the year’s net income. Those account balances are then transferred to the Retained Earnings account. When the year’s revenues and gains exceed the expenses and losses, the corporation will have a positive net income which causes the balance in the Retained Earnings account to increase. Suppose your business had a beginning retained earnings balance of $15,000.

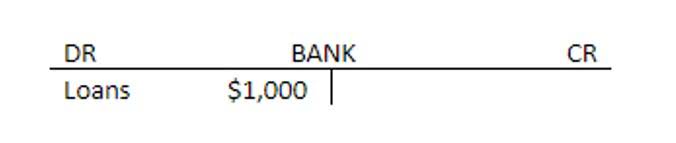

- For example, a company will have a Cash account in which every transaction involving cash is recorded.

- These earnings are part of the shareholders’ equity and are reported on the balance sheet under the equity section.

- Retained earnings refer to the historical profits earned by a company, minus any dividends it paid in the past.

- Thus, the retained earnings are credited to the Retained Earnings Account.

- It also indicates that a company has more funds to reinvest back into the future growth of the business.

Normal Balance and the Accounting Equation

High retained earnings can indicate a history of profitability and a reservoir of funds available for investment or emergencies, enhancing the company’s stability and flexibility. Conversely, negative retained earnings might suggest financial distress or an aggressive dividend policy, potentially weakening the company’s financial position and growth prospects. Retained earnings offer a window into a company’s retained earnings debit or credit balance financial soul, encapsulating its ability to churn profits and sustain itself without leaning on external funding. A sturdy, growing retained earnings balance can indicate financial wellness—it suggests that a company earns more than it spends and invests those profits wisely. An alternative to the statement of retained earnings is the statement of stockholders’ equity. A gain is measured by the proceeds from the sale minus the amount shown on the company’s books.

How do I find retained earnings and what is the formula for retained profit?

If significant capital investments are anticipated, retaining earnings to cover these costs can be more advantageous than external financing. Businesses use QuickBooks this equity to fund expensive asset purchases, add a product line, or buy a competitor. Dear auto-entrepreneurs, yes, you too have accounting obligations (albeit lighter!).

- The board of directors also declares the amount and timing of dividend distributions, if any, to the stockholders.

- Established businesses that generate consistent earnings make larger dividend payouts, on average, because they have larger retained earnings balances in place.

- Retained earnings are a positive sign of the company’s performance, with growth-focused companies often focusing on maximizing these earnings.

- If for instance, the company incurred losses of $100,000 the journal entry for the loss will be recorded as shown below.

- Profitable businesses face tough choices about allocating retained earnings.

- A stockholders’ equity account that generally reports the net income of a corporation from its inception until the balance sheet date less the dividends declared from its inception to the date of the balance sheet.

Preferred Stock

When this is the case, the account will be described as Deficit or Accumulated Deficit on the corporation’s balance sheet. The retained earnings are reported on the company’s balance sheet under its stockholder’s equity section. This amount is usually held in a reserve by the company and could be used to increase the company’s asset base or reduce some of its liabilities. A company’s net income is the amount remaining from its revenue after it has deducted its operational expenses and made dividend payments. Thus, the leftover amount that the company was able to generate within the accounting period in view is usually transferred to the retained earnings account.

- This is the retained earnings amount from the end of the previous financial period.

- It’s also important to evaluate the impact of strategic decisions, such as entering new markets or launching new products, on retained earnings.

- If a state requires a par value, the value of common stock is usually an insignificant amount that was required by state laws many years ago.

- Thus, they do not have sufficient patronage to ensure their profitability yet.

- The treatment of retained earnings in a merger or acquisition depends on the nature of the transaction.

- However, the past earnings that have not been distributed as dividends to the stockholders will likely be reinvested in additional income-producing assets or used to reduce the corporation’s liabilities.